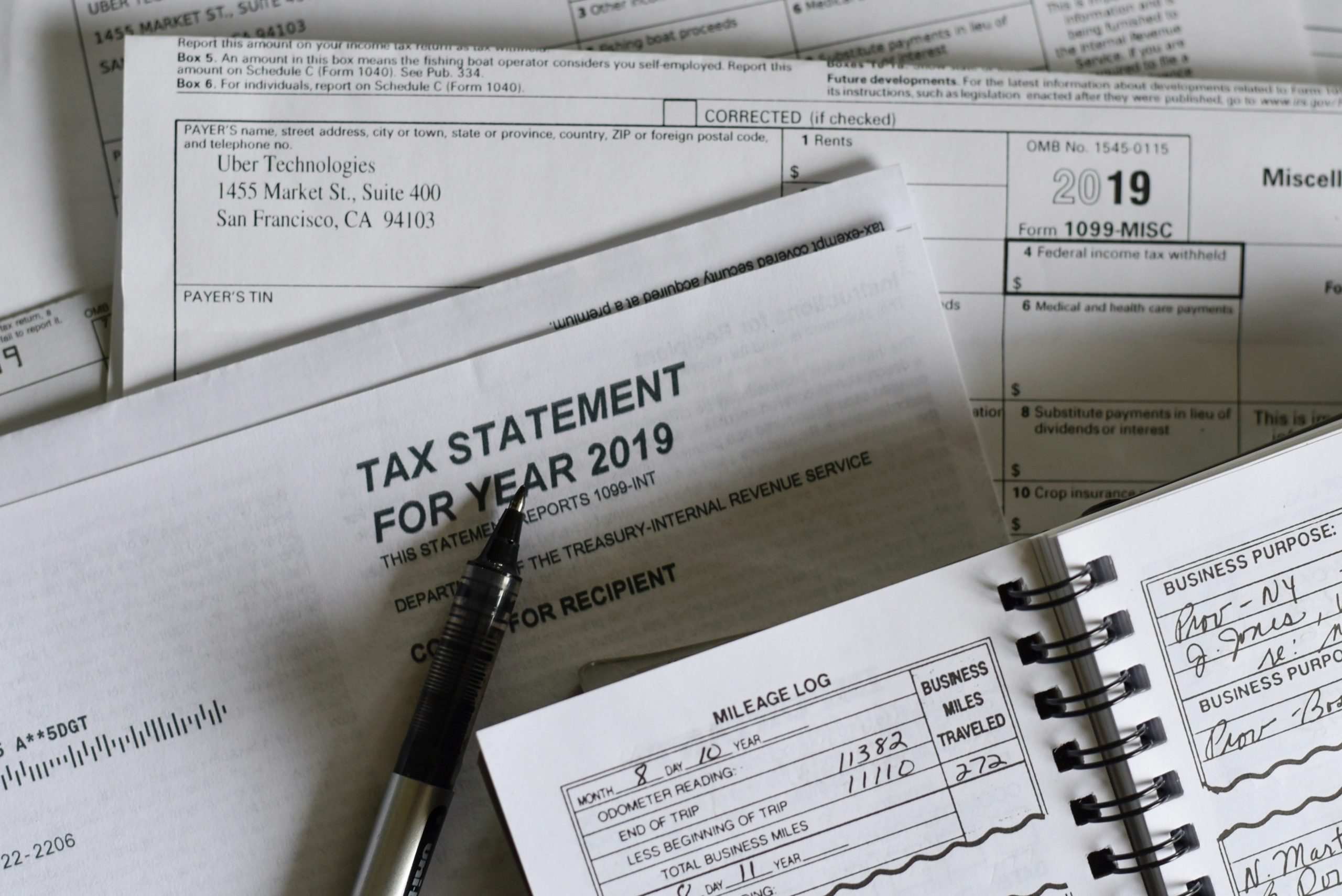

A new government initiative aimed at simplifying tax reporting for self-employed individuals and landlords somes into effect from April 2026.

Making Tax Digital (MTD) for Income Tax Self-Assessment (ITSA) is a system that will require digital record-keeping of income and expenses, with mandatory quarterly updates to HM Revenue & Customs using compatible software.

Take a look at this handy overview here from our colleagues at Accounts & Tax Made Easy.

Follow us on socials for more news and updates

Impossible – until it’s done

Big achievements can often seem impossible - until someone makes them happen. That is the view of the team at Diligent Eye - a team of experts who have spent seven years building a system that makes...

UK rental property market forecast 2025

The UK rental property market in 2025 is being shaped by multiple economic factors, report the team at Holland Asset Management. As inflation rises due to transport and food costs, together with new...

Spring has sprung

It is no surprise that Spring is often many people's favourite season of the year. Spring is important because it marks a period of renewal, rebirth, and increased activity in the natural...

Why property investors should have an estate plan

If you’ve spent years building a property portfolio, you know planning is important. You might have started with one rental and added more over time. You’ve picked good locations, dealt with...

Protecting your share of your home with your will

You and your partner have built your dream home....but what happens if your circumstances change and you part ways? Did you know what if your will is set up properly, you can protect your share in...

Home is where your health is…..

Home is where the heart is....but what about home is where your health is, a more fitting sentiment perhaps? The spaces we inhabit have a profound impact on our physical, mental and emotional...

Limited or personal…that’s the question!

There are many reasons to get excited about the potential financial returns that buy-to-let property offers. But it is vital that any investor and budding landlord completes their financial due...

Raise your hand for property auctions

Selling or buying property at auction is an attractive option, with benefits for both buyers and sellers. Property up for sale at auction can often sell in a matter of days, in contrast to property...